The owners of The Daily Telegraph are eyeing a £4bn windfall from a flotation of Very Group, their online shopping empire.

Sky News has learnt that the Barclay family has appointed STJ Advisors, which works with companies ahead of public listings, to prepare Very Group for a stock market debut next year.

The appointment of STJ is the clearest sign to date that the Barclays are intent on taking one of their businesses public for the first time.

Nevertheless, sources cautioned that a partial stake sale, with the company remaining privately held, also continued to be an option.

The family has owned Very Group – formerly Shop Direct – for nearly 20 years, during which they abandoned its historic Littlewoods catalogue and stores as consumer shopping habits migrated online.

AdvertisementThe site sells clothing, electrical goods and toys, among other categories, and has become one of the UK’s biggest online retailers.

As well as Very, the Barclays also own the Daily and Sunday Telegraph newspapers and Yodel, the logistics group.

More from Business COVID-19: Concerns mount over ‘pingdemic’ as Test and Trace app wreaks havoc GSK to build £400m hub in Stevenage – creating 5,000 jobs Saudi state fund buys McLaren stake in £550m deal COVID-19: Car maker Rolls-Royce ‘approaching critical point’ over COVID alert worker absences Quantatative easing, South African unrest, Open golf Airbnb listings lead to increased neighbourhood violence, study findsA bitter fight within the billionaire family erupted last year over its sale of London’s Ritz Hotel, with a truce declared over alleged “commercial espionage on a vast scale” only last month.

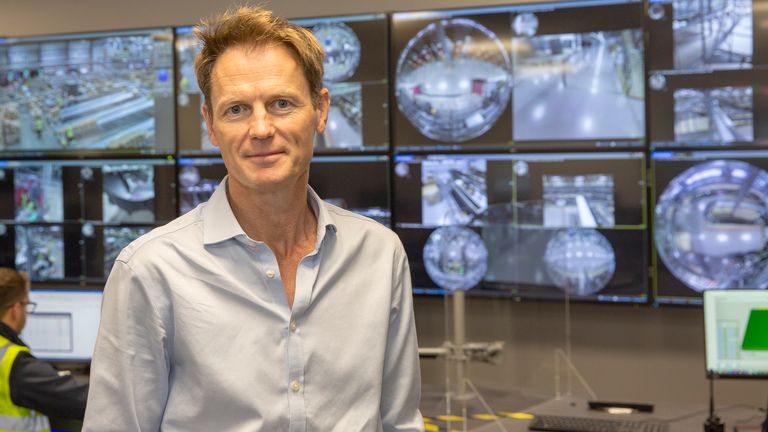

Image: Henry Birch, CEO of Very GroupThe Barclay twins – Sir David and Sir Fredrick – built one of Britain’s biggest private business empires, spanning media, property and retail assets.

Sir David’s death earlier this year is said to have accelerated a further evaluation of the family’s corporate interests.

Investment banks are being sounded out about working on a listing.

A flotation of Very Group would be a logical move given the online shopping boom spurred by the coronavirus pandemic.

One source close to the company said it was “well-positioned to continue our strong trading throughout 2021”.

Full-year results for the 12 months to the end of June 2020 showed revenues of more than £2bn for the first time

Critical questions for fund managers who are approached about buying Very Group’s shares in an initial public offering will be the company’s ongoing governance structure and the extent of the Barclay family’s continued ownership.

They will also be expected to seek reassurance about the company’s confidence in its future sales and earnings growth.

Very Group is run by chief executive Henry Birch, the former Rank Group boss.

A number of online retailers, including THG Holdings, the owner of The Hut Group, have gone public in the last 12 months and seen their valuations subsequently increase.

Taking one of their corporate interests public would be a radical departure for the Barclays, who have always been protective of their privacy.

This year’s Sunday Times Rich List estimated that the family had amassed Britain’s 28th-largest fortune, worth £6bn.

While high street chains have invariably been struggling to stay afloat, Very reported in its recently concluded financial year what it described as record-breaking Christmas and Black Friday trading performances.

Sales in the third quarter of its financial year soared by more than 50%.

The Barclays previously explored the possibility of bringing in external investors to Very Group in 2017, when it held talks with a number of large private equity firms.

A spokesman for the company declined to comment on Friday.