House prices make modest rebound in May as confidence improves, says Nationwide

The average UK house price saw a modest bounce back in May after two months of falls in what experts called a sign of market “resilience”, according to an index.

UK property prices rose 0.4% month-on-month, following a fall of 0.4% in April, Nationwide Building Society said.

The rise leaves the average house price at £264,249. Meanwhile, the annual rate of house price growth more than doubled to 1.3% in May, from 0.6% in April.

Robert Gardner, Nationwide’s chief economist, said: “The market appears to be showing signs of resilience in the face of ongoing affordability pressures following the rise in longer term interest rates in recent months.

The results of the election are unlikely to make a material difference to house prices

Anna Clare Harper

Year-over-year growth rose to 1.3%, from 0.6% in April.

Separately, HMRC data released on Friday showed a fourth consecutive monthly rise in house sales in April, rising 5% to 90,430.

The increase coincided with a fall in the higher rate of capital gains tax for house sales.

It comes after slight increases in mortgage rates since the start of the year slowed the housing market through March and April.

According to Moneyfacts, at the end of January, the average two-year fixed rate mortgage cost 5.56%, rising to 5.92% by the end of May.

Experts think the Bank of England is likely to cut interest rates August or September, while headline inflation eased to 2.3% in the 12 months to April 2024, down from 3.2% in the 12 months to March.

Mr Gardner added: “Consumer confidence has improved noticeably over the last few months, supported by solid wage gains and lower inflation.”

Read More

Sarah Coles, head of personal finance at Hargreaves Lansdown, added: “Higher house prices are themselves a barrier for an awful lot of buyers, because when coupled with higher mortgage rates, the monthly payments are pushed out of reach.

“However, buyers are pushing through, which owes an awful lot to people’s confidence in their own personal financial position – which Nationwide figures show has turned positive after years of negativity.

“The easing of inflation, coupled with robust wage growth, and relatively low levels of unemployment, mean people are feeling more secure.”

Earlier this week a separate index, by property website Zoopla, showed that Britain’s supply of homes for sale is at its highest point in eight years, in a trend which experts said will limit house price rises for the rest of 2024.

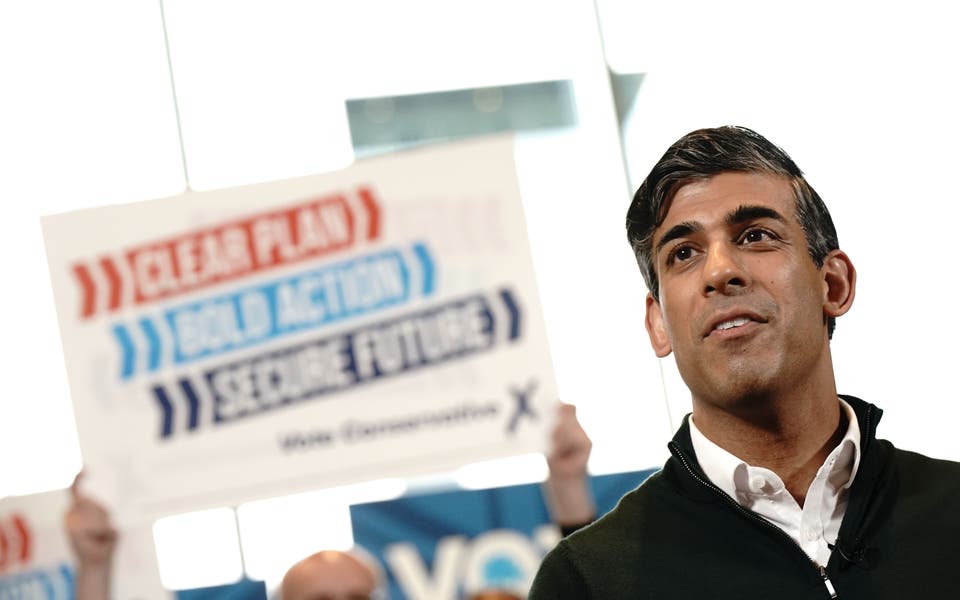

Meanwhile, Nationwide research showed that the upcoming General Election is unlikely to have a significant impact on house prices.

Previous polls have not affected underlying market trends, the research showed, as buyers sought to plough on with sales regardless of events in Westminster.

Anna Clare Harper, chief executive of sustainable investment adviser GreenResi, says: “The question everybody is asking is what impact will the election – and its results – have on the property market.

“Elections make investors and aspiring homeowners nervous. However, the truth is that the results of the election are unlikely to make a material difference to house prices.

Nathan Emerson, chief executive of Propertymark, said: “We are conscious there may be a potential slowdown across the summer as a knock-on effect following the General Election.

“But with inflation firmly on its journey downward and with scope for interest rate cuts, we may soon see a much welcome influx of highly competitive deals from lenders hit the marketplace.”