Private demand for new diesel cars growing faster than for EVs

Private demand for new diesel cars is growing faster than for pure battery electrics, new figures show.

The Society of Motor Manufacturers and Traders (SMMT) said registrations of new diesel cars for private buyers in September grew by 17.1% compared with the same month in 2023, up 1,367 units.

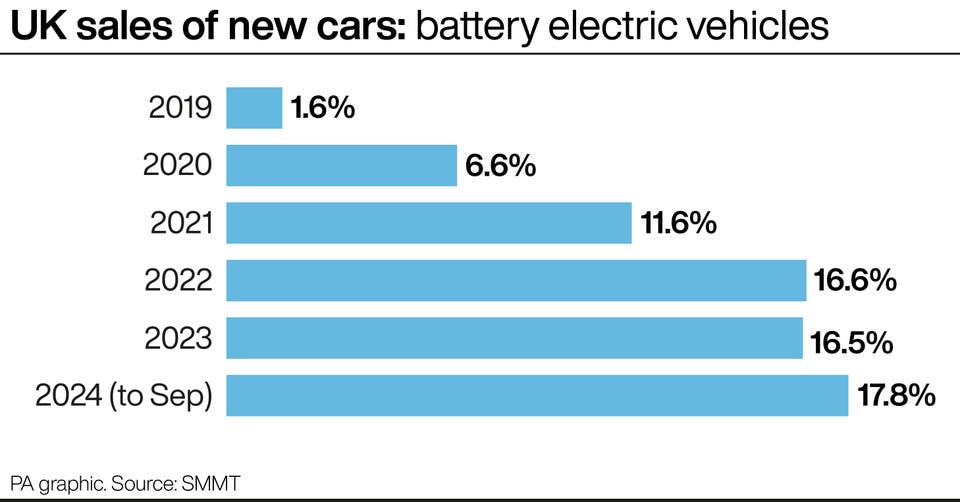

That is compared with a 3.6% year-on-year rise for pure battery electrics – up 410 units – despite heavy discounting by manufacturers.

The SMMT said car makers are on course to “spend at least £2 billion on discounting electric vehicles (EVs)” this year in an effort to offset the “underlying paucity of demand”.

September was a record month in terms of overall battery electric new car registration volumes, at 56,387 units.

The SMMT and senior UK leaders at major vehicle manufacturers such as Ford, Stellantis, JLR and Volkswagen Group have written to Chancellor Rachel Reeves calling for urgent support to encourage more consumers to switch to electric motoring, ahead of her Budget on October 30.

The signatories called for measures such as halving VAT on new EV purchases and reducing VAT on public charging from 20% to 5% to match the home charging rate.

They wrote: “We appreciate the severe constraints on the public purse, but deliver this support to consumers and the benefits are myriad: a thriving market, enhanced consumer choice and affordability, investment attractiveness, high-value job creation, cleaner air, quieter streets and economic growth.

“We know your Government is committed to a vibrant and competitive UK automotive industry.

“With the right measures, the right consumer support, we can fix the foundations of this transition and with it deliver the biggest technology transition ever attempted, and the economic growth and environmental improvements that should be non-negotiable.”

The signatories added that the industry will “likely miss” targets set by the zero emission vehicle mandate, which requires at least 22% of new cars and 10% of new vans sold by each manufacturer in the UK this year to be zero emission, which in most cases means pure electric.

Manufacturers face being required to pay the Government £15,000 per polluting vehicle sold above the limits, or purchase credits from rival companies.

The letter warned that “these are not consequence-free choices”, and it is “the consumer who pays” as costs are passed on.

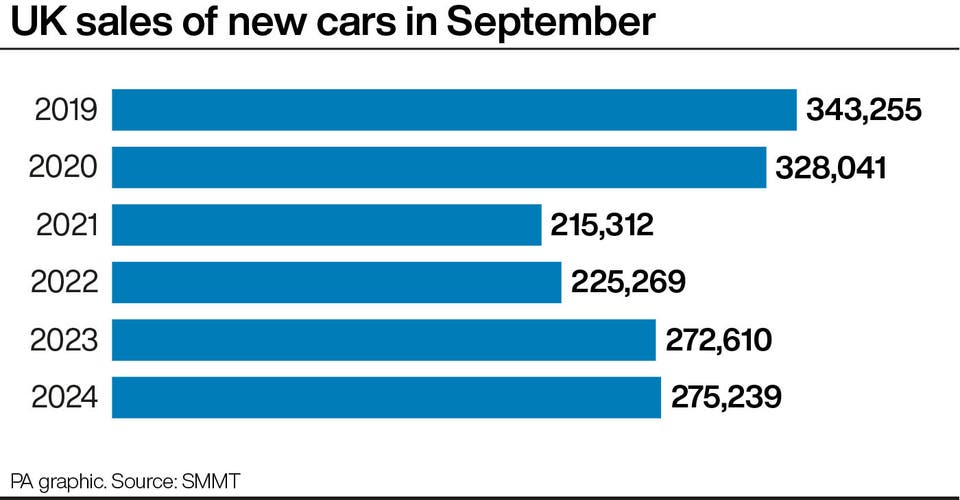

The overall number of new cars registered last month rose by 1.0% year on year to 275,239 units.

September is traditionally a bumper month for the industry due to the release of new number plates.

Market weakness is putting environmental ambitions at risk and jeopardising future investment

Mike Hawes, Society of Motor Manufacturers and Traders

Growth was driven by purchases for fleets owned or leased by businesses or other organisations, which were up 3.7%.

Private consumer demand fell by 1.8%, while the smaller business sector saw volumes decrease by 8.4%.

SMMT chief executive Mike Hawes said: “September’s record EV performance is good news, but look under the bonnet and there are serious concerns as the market is not growing quickly enough to meet mandated targets.

“Despite manufacturers spending billions on both product and market support – support that the industry cannot sustain indefinitely – market weakness is putting environmental ambitions at risk and jeopardising future investment.”

Ian Plummer, commercial director at online vehicle marketplace Auto Trader, said: “Electric vehicle sales surged in September.

“Record discounts are driving the interest as brands and retailers do all they can to stimulate sales, showing once again just how sensitive the market is to financial incentives, and the importance of overcoming the current EV cost barrier.

“There’s still much to do to drive further levels of interest and sales – and discounts can only last so long.

“Other measures are needed to help buyers make the switch to electric cars which still carry a 30% price premium over their ICE (internal combustion engine) counterparts.”