EasyJet shares take a pounding as it reveals rejected takeover bid and £1.2bn cash call

EasyJet has revealed that it rejected an unsolicited takeover approach while again moving to shore up its finances as it looks to recover from coronavirus disruption.

The low-cost airline said the all-share approach – understood to have come from Wizz Air though that was not confirmed by either party – fundamentally undervalued the business.

EasyJet said the unwanted suitor had since walked away and it would use a rights issue to strengthen its balance sheet in response and also to take advantage of growth opportunities from the expected recovery in Europe’s aviation market.

It said the fully-underwritten offer would enable shareholders to buy 31 new shares for every 47 existing shares at a discounted price of 410 pence each.

The company said the move would raise £1.2bn and would be complemented by a new $400m (£290m) secured revolving credit facility with its banks.

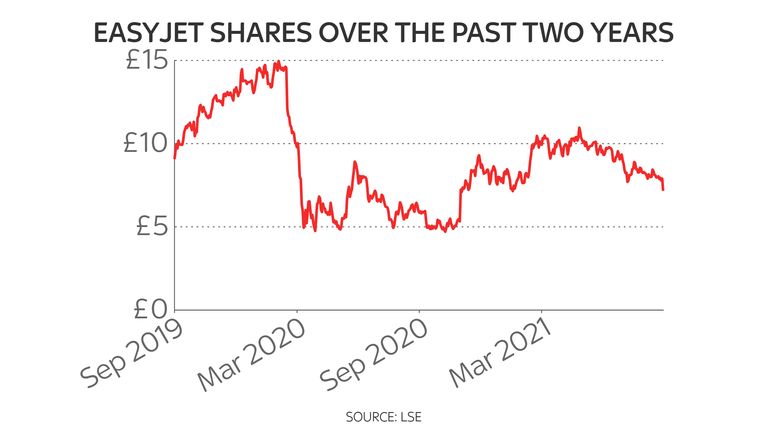

Shares plunged by 10%.

Chief executive Johan Lundgren, who has been critical of the government’s approach to the relaxation of international travel, said the capital raise would enable the airline to accelerate its post-COVID-19 recovery plan and position it to take advantage of strategic investment opportunities.

They included expanding its presence at key airports by buying more landing slots.

“This capital increase will allow us to build on our fundamental operational strengths and network strategy for our customers as well as accelerate long-term value creation for our shareholders,” he said.

The Reuters news agency cited a source in naming Wizz as the spurned bidder for easyJet, with market analysts saying that any combined company could have created an airline to mount a serious challenge to Ryanair’s European dominance in terms of passenger numbers.

The cash call marked the second such equity raising in just over a year for easyJet.

Neil Wilson, chief market analyst at Markets.com, said of the share price plunge: “The fact that a leading and – going into the pandemic – well-capitalised airline is, some 18 months or so on from the start of the crisis, still needing to raise fresh capital is a sign of the ongoing trouble in the sector.

“Demand remains the central problem: in Q4 2021 easyJet expects to be flying 57% of 2019 capacity, and up to 60% in Q1 2022.”