Energy boss claims 20 more suppliers face bankruptcy over ‘£5bn’ price cap bill

The boss of one of the UK’s largest household energy firms has demanded urgent changes to the price cap shielding consumers from huge price rises, telling Sky News the industry is bearing a £5bn bill and “at least 20” more suppliers face bankruptcy as a result.

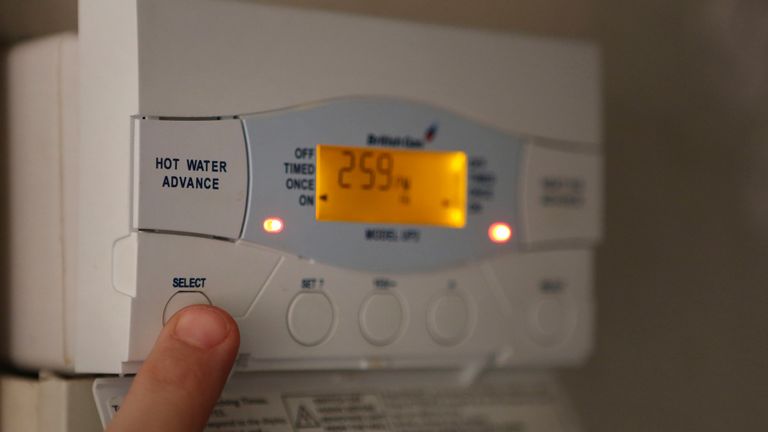

Scottish Power chief executive Keith Anderson said the price cap, introduced under the government of Theresa May to protect customers from “rip-off” tariffs, should become more reflective of the cost for suppliers to buy energy from the wholesale market.

He suggested the cap, if it was to be retained, should be reviewed at least four times a year instead of twice.

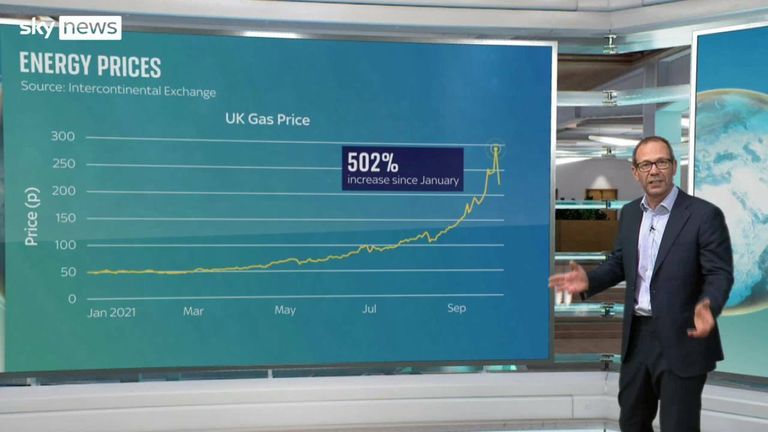

Mr Anderson was speaking as suppliers and their customers pay the price of a six-fold spike in the cost of raw energy over the past 12 months – a surge that has forced 15 small providers out of business this year.

The rise in wholesale gas costs in particular has proved unaffordable as companies with less financial clout are forced to buy their energy closer to the point of delivery.

Mr Anderson said that as more customers fall off their fixed-term tariffs and onto a cap-regulated tariff, protecting them from the worst of the wholesale price rises, more energy suppliers would go bust over the next six months.

“The impact of that, if nothing else changes between now and then, we think you could see by that time the market return to five or six companies, and you could go all the way back to a new version of the Big Six,” he said.

“I don’t think that’s in the industry’s interest, it’s not in customers’ interest, and it’s not in the interest of the regulator either.”

He told Ian King Live: “The cap needs to be much much more reflective of what’s going on in the marketplace.

At the end of the day, customers will end up paying for these much higher gas prices and we think the cap should reflect that more frequently than every six months and in addition to that… what I’m saying is there should be a special tariff…for the fuel poor and the vulnerable.”

The price cap was adjusted 12% higher by Ofgem from 1 October to reflect rising wholesale prices seen only up to August.

An economist told Sky News on Wednesday that the next review, which is due to take effect in April, could see a further increase of 30%.

While that prospect has sparked warnings about affordability for households, the industry says it is losing about £1,000 per customer when they move onto a default tariff under the price cap currently.

Mr Anderson added: “We think probably in the next month at least another 20 suppliers will end up going bankrupt.”

Follow the Daily podcast on Apple Podcasts, Google Podcasts, Spotify, Spreaker

Ofgem responded: “Ofgem is working closely with government and industry to ensure that customers remain protected.

“We have robust systems in place to ensure this.

“The price cap will remain in place this winter to protect millions of people from the sudden increases in global gas prices.

“We are also working with government to ensure that we have a sustainable energy market that works for all customers.”