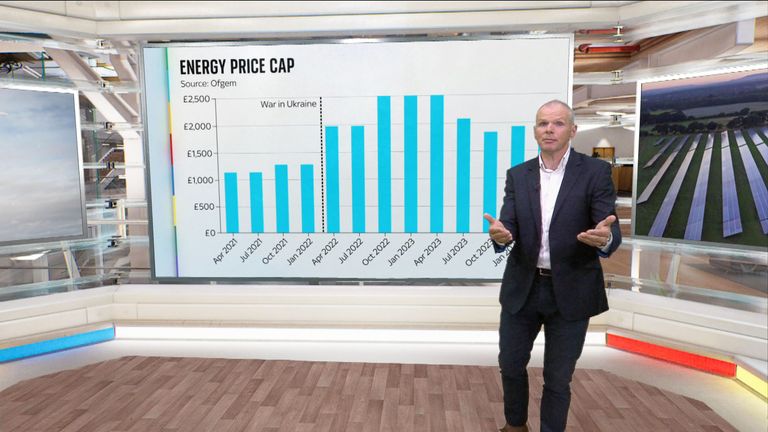

Energy price cap falls today but ‘£600 lift to annual bill ahead’

As the latest reduction in the energy price cap takes effect, households are being warned of a big lift in bills ahead due to higher wholesale gas prices.

The cap, which limits what suppliers can charge per unit of energy, fell by 7% overnight in the wake of the latest three-month review by industry regulator Ofgem.

The reduction meant that typical 12-month bills will be around £500 cheaper than a year ago.

It left the average bill at £1,568 – a figure that will apply until the result of the next review takes effect in October.

However, a report by the Energy & Climate Intelligence Unit (ECIU) said on Monday that consumers should brace for an additional hit of up to £600 over the coming winter, largely due to higher wholesale prices.

It pointed to a possible £200 price cap hike from October on the back of some analyst calculations, suggesting it was plausible the total could remain around that level until June.

One calculation, by experts at Cornwall Insight and released on Friday, predicted a 10% – or £155 – increase from 1 October to £1,723 a year but said there remained uncertainty on the market path ahead.

Consumer groups say there is an alternative to the price cap, pointing to a growing number of fixed-rate deals on the market following a dearth of competition in recent years.

European wholesale costs are again elevated for the time of year based on pre-energy shock norms.

Recent pressures have included strong competition from Asia, particularly China, for liquefied natural gas (LNG).

That has replaced some of the Russian natural gas volumes that were stripped away in the wake of the invasion of Ukraine in February 2022.

A planned extension of the European Union’s sanctions regime against Russia will see its LNG exports targeted for the first time – potentially placing further pressure on supply across the continent.

👉 Click here to follow The Ian King Business Podcast wherever you get your podcasts 👈

UK household costs for both gas and electricity stood at an average of just below £1,090 ahead of the Russia-Ukraine war.

The ECIU report said: “By September 2025, the average household could have paid an extra £2,600 on energy bills during the ongoing gas crisis.

“With the government also spending £1,400 per home earlier in the crisis, the total extra costs could be £4,000 per home, and counting.”

Energy has been among the big battlegrounds of the election.

Much of the debate has centred on costs but the impact of gas use in particular has fuelled argument too on the UK’s climate commitments.

Dr Simon Cran-McGreehin, head of analysis at ECIU, said: “The UK’s high dependence on gas for electricity generation and heating has cost bill payers £2,000 so far during the gas crisis and the economy as a whole tens of billions of pounds.

“Common sense measures like investing in insulating the poorest homes, switching to electric heat pumps and fast-tracking British renewables will leave us less vulnerable to the whims of the international gas markets.

“North Sea gas output is declining so unless we make the switch we’ll be ever more dependent on foreign imports.

“The maths is clear, when it comes to energy independence, new drilling licences are a side show making a marginal difference compared to the immense quantity of homegrown energy that offshore wind and other renewables can generate.”

Read more:

EU sanctions on Russian LNG could have gone much further

Be the first to get Breaking News

Install the Sky News app for free

Emily Seymour, the editor of Which? Energy, said: “Consumers will be relieved to hear that the price cap is dropping by around £122 for the typical household from 1st July.”

She added: “With the price cap predicted to rise again in October, many consumers will also be wondering whether to fix their energy deal.

“There’s no ‘one size fits all’ approach but the first step is to compare your monthly payments on the price cap to any fixed deals to see what the best option is for you.

“As a rule of thumb, if you want to fix, we’d recommend looking for deals as close to the July price cap as possible, not longer than 12 months and without significant exit fees.”