Five charts that explain why water bills are about to go up

This is a crucial week for the water industry.

Regulator Ofwat will on Thursday give its “final determination” on how much bills will rise over the next five years.

Before then, Britain’s largest company Thames Water hopes to win court approval for a £3bn bridging loan to stop it running out of cash in the spring.

Together they amount to the greatest test of the water system, the only fully privatised network in the world.

To understand how we got here, and what might happen next, it pays to go back to the beginning.

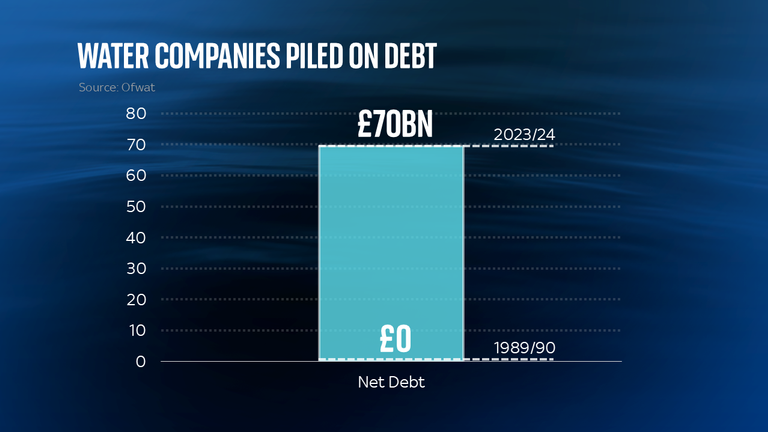

In 1989, 10 state-owned regional water and sewage companies in England and Wales were sold off by Margaret Thatcher’s government, raising £7bn for the Treasury. The companies were sold debt-free but never intended to stay that way.

The rationale was that the private sector could raise the billions required to upgrade the Victorian sewage network, and fund it from customer bills, so the state didn’t have to.

So borrowing was always part of the plan and, as of this year, the companies have accrued £70bn of net debt, at a ratio to equity (gearing) of around 85%.

In water the problem with debt is not the total, but whether the companies can afford to service it, and what they did with the money.

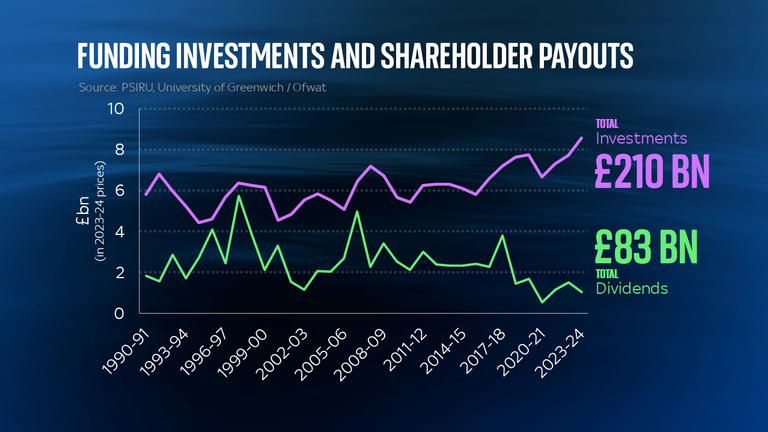

The answer to the first question varies by operator, but water companies have poured billions into infrastructure and other investments. Adjusted for inflation, investment has run at between £4bn and a record £9bn last year, a total of £210bn in today’s prices, spending that has reduced leakage and improved water quality on some measures.

But it has not been enough to meet public expectation of basic services, of sewage control, or to the challenges of climate change and a growing population. To pick one example, the UK has not built a new reservoir since 1992.

At the same time, the companies’ shareholders have extracted dividends of £83bn (as calculated from Ofwat figures by the University of Greenwich and adjusted for inflation).

But like debt, dividends are a deliberate feature of the privatised system. Investors in any industry need to make a return.

Water UK, the companies’ trade body, says that since 2020, when the regulator began paying closer attention to payouts, dividends have averaged 2.7%.

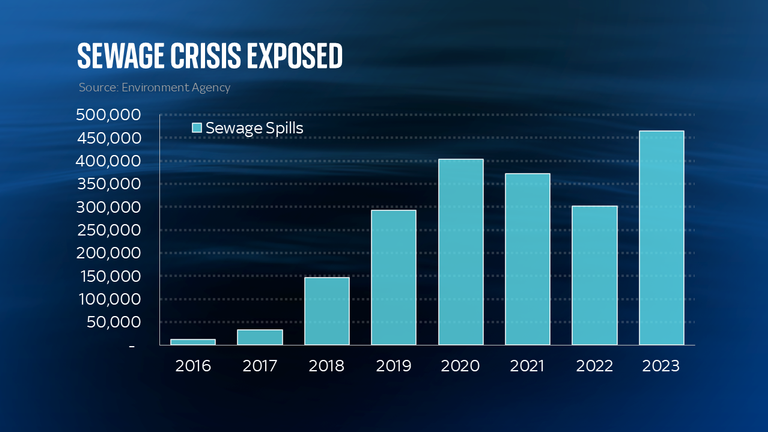

The level of dividends and executive bonuses have become harder to defend with the emergence of the water industry’s dirty secret; sewage outflows.

These occur when the pipes shared by sewage and rainwater become inundated and, as a failsafe, are deliberately discharged into waterways through storm overflows to prevent sewage backing up into homes and businesses.

For decades the full extent of their use was unknown, with industry, regulators and the public in the dark because of the absence of monitoring. That has changed in the last decade, with full monitoring of almost 15,000 overflows in England revealing more than 460,000 sewage outflows in 2023.

Public outrage has pushed the issue up the political agenda, increasing the pressure on companies.

The water industry can point to some success in improving water quality since privatisation, with a reduction in levels of phosphorus and ammonia and 85% of bathing water classified as “good” or “excellent” by the Environment Agency.

But none of those are in rivers, where wild swimming, and the public activism that comes with it, is a recent phenomenon. And as public expectations for water quality rise, so do costs.

The challenge for the industry is that the cost of addressing the mess – whether physical, financial or of their own making – has just got more expensive.

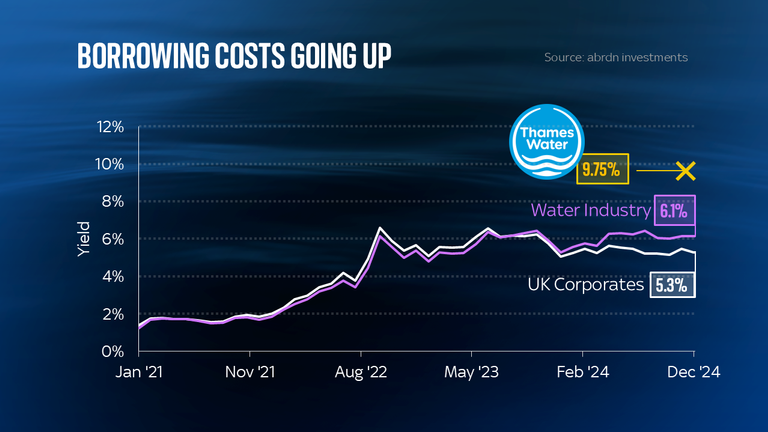

Water was once a haven for long-term investors who enjoyed reliable returns from monopoly providers of an essential resource. For many years, water enjoyed a “halo effect” with cheaper borrowing costs than other industries.

This chart shows yields for water industry bonds, effectively the interest rate on their debt, compared to an index of other UK corporate bonds. While borrowing costs for everyone increased following the global inflation spike in early 2022, water remained cheaper.

In July 2023, after the full scale of the crisis at Thames Water emerged, the lines crossed over and water debt became more expensive. Water now has a premium attached, growing to almost a full percentage point by the end of this year.

And it is not just Thames. Ratings agencies have downgraded several water companies, damaging confidence in the entire sector. All companies face higher costs for borrowing, from the publicly listed Severn Trent, to distressed Thames, trying to secure terms on a £3bn bridging loan at an eye-watering 9.75%.

To meet these rising costs of capital water companies are now arguing that Ofwat should not only let them raise customer bills, but that investors need a greater return to commit money to the sector.

Luke Hickmore, investment director at abrdn, part of the Thames Water creditors’ group, said: “Water companies are facing a significantly higher cost of funding at the same time as seeing a growing need for infrastructure investment to maintain water and sewage systems.

“Investors have placed a risk premium on the entire industry because of uncertainty over whether the regulatory framework can support this increased investment need, and this drop in confidence has accelerated since Ofwat’s Draft Determination in July.

“Weaker companies with higher debt have suffered more, right at the time when many of them are looking for additional capital to meet the needs of customers and environment for the next five years and beyond.

“This financial strain and deteriorating investor support means higher cost of borrowing, which eventually feeds through to customer bills.”

All of which means your water bill is about to go up, though how much depends on where you live, and unlike other privatised utilities you can’t switch.

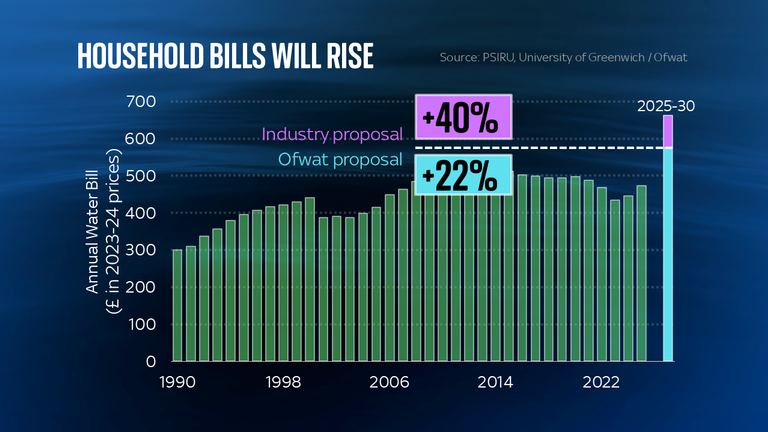

In July, Ofwat said bills could rise by an average of 21% to fund £88bn of spending, but the water companies are now asking for 40% to cover an investment of £107bn.

Wherever Ofwat draws its line this will be the most significant bill hike since privatisation. For decades the regulator and politicians were focused on affordability, leaving bills lower in real terms today than they were a decade ago.

But it is clearer than a chalk stream that this approach stored up trouble, and whether you blame poor management, corporate greed, slack regulation, political indifference, or the principle of privatisation itself, the industry faces a critical moment.