Food leads rate of inflation down to 3.4%, lowest level since September 2021

The rate of inflation slowed sharply to an annual rate of 3.4% in February, according to official figures charting a big contribution from food costs.

Data from the Office for National Statistics (ONS) showed an easing in the headline measure from the 4% rate recorded the previous month to a level last seen almost two-and-a-half years ago.

It was led, the report said, by food prices being almost flat this year compared with a large rise last year, while restaurant and café price rises also slowed.

Money latest: Reaction as UK inflation eases by more than expected

“These falls were only partially offset by price rises at the [fuel] pump and a further increase in rental costs,” ONS chief economist Grant Fitzner said.

The data marks further progress in the battle against energy-led price growth that followed Russia’s war in Ukraine.

The data does not mean that overall prices are falling but rising at a slower pace than they were, now at a level well below the pace of wage increases which were last measured around 6%.

Inflation is forecast to fall back below the Bank of England‘s target rate of 2% in the next few months.

However, the Bank’s interest rate-setting committee is widely expected to hold off on removing the medicine it has dished out to tackle inflation, possibly until the summer.

Its latest rate decision is due on Thursday.

Interest rate cuts would provide relief to millions of borrowers who have faced hefty increases to their costs as a consequence of higher interest rates.

But committee members are wary of starting the process as it’s feared inflation may tick back up in the second half of the year.

While there was some comfort in the latest data from core inflation figures, which strip out volatile elements such as food and energy costs, they are waiting for visibility on many price pressures including the pace of wage growth, disruption to shipping in the Red Sea and rising global oil costs.

Regular pay rises, according to separate ONS data last week, were still running above 6% – a level that could help drive demand in the flatlining economy and force up the pace of price increases.

Brent crude oil costs hit levels not seen since October last year earlier this week at $87 per barrel.

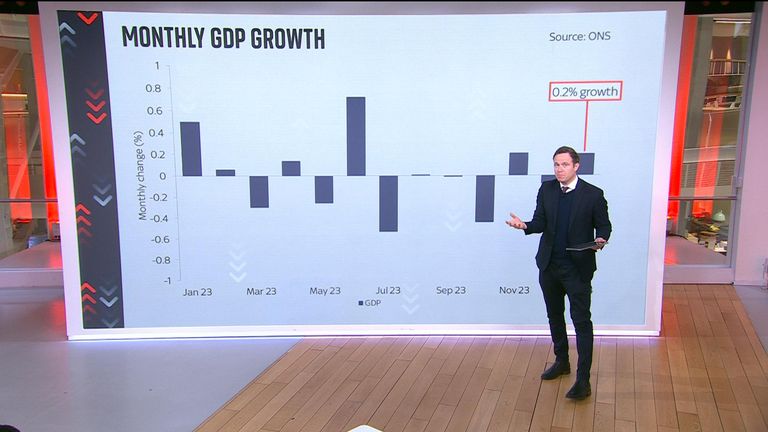

Interest rate cuts would help put more money back in people’s pockets over time, boosting the economy which officially entered recession in the second half of last year.

The economy is predicted to be the main battleground in the looming election so the timing of such action, by the politically neutral Bank, could be crucial.

London Stock Exchange Group (LSEG) data suggests the market expects the first cut to come in June but there is a growing school of thought that inflation may remain stickier than expected by that time, leaving August more in the frame.

Chancellor Jeremy Hunt said of the inflation data: “The plan is working. Inflation has not just fallen decisively but is forecast to hit the 2% target within months.

Be the first to get Breaking News

Install the Sky News app for free

“This sets the scene for better economic conditions which could allow further progress on our ambition to boost growth and make work pay by bringing down national insurance as we work towards abolishing the double tax on work – but only if we can do so without increasing borrowing or cutting funding for public services.”

Rachel Reeves, Labour’s shadow chancellor, responded: “After fourteen years of chaos and uncertainty under the Conservatives working people are worse off. Prices are still high, the tax burden is the highest it has been in seventy years and mortgage payments are going up.

“Now Rishi Sunak is putting forward a reckless £46bn unfunded tax plan to abolish National Insurance that would risk crashing the economy and re-running the disastrous Liz Truss experiment.

“Britain cannot afford another five years of this failed Conservative government. It’s time for change and it’s time for Rishi Sunak to set the date for the election.”