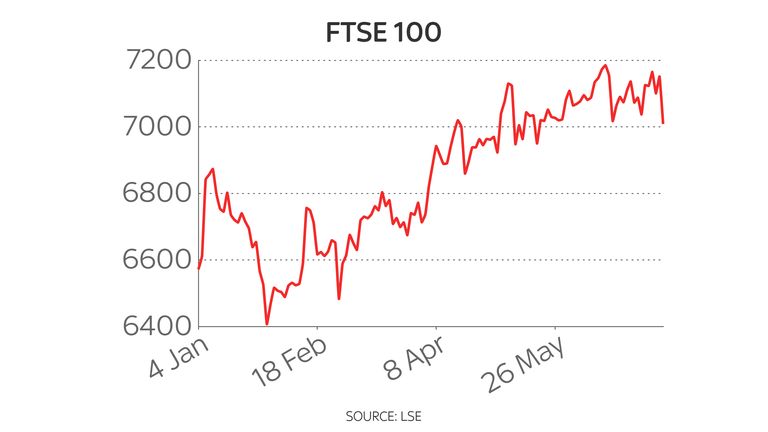

FTSE 100 slips below 7,000-mark as economic jitters spark global sell-off

Global stock markets have plunged on a cocktail of concerns about the global economy and anxiety over how central banks are responding to inflation.

London’s FTSE 100 Index fell by 170 points, or more than 2%, at one stage as the sell-off wiped away any overnight cheer brought about by England’s Euros victory against Denmark.

That saw it dip below the 7,000-mark, erasing some of the strong gains the index has seen in recent months as stocks recovered following last year’s pandemic-induced slump.

It closed the session 1.7% down at 7,030. In cash terms, it meant £32bn was taken from the FTSE 100’s market value overall.

The biggest fallers included global mining giants such as Anglo American and Glencore – whose fortunes tend to be linked to global economic currents especially in China, and each lost around 5% of their value early in the day before recovering.

Also facing a sell-off were housebuilders led by Persimmon – which reported a bounce-back in half-year revenues but cautioned on the ongoing uncertainties faced by the UK economy including supply chain difficulties.

Banking stocks were in the red too amid the gloomy outlook, led by Barclays.

Only a handful of blue-chip companies managed to eek out gains, with British Airways owner International Airlines Group – which stands to benefit as quarantine rules on visiting amber list countries are eased – up but only slightly by the close.

Earlier, there were upturns for the likes of takeaway app Just Eat and Ladbrokes owner Entain, which operate in sectors that stand to gain from a football-linked spending boost.

But the cheer faded as they also became enveloped in the market slide which was replicated in similar falls across French, German and Italian bourses and followed a tough session for Asian indices overnight.

Among the factors grabbing investors’ attention was the disclosure on Wednesday that US Federal Reserve officials had discussed the possibility of removing some of the economic stimulus that has helped markets recover over the past year.

The Fed has been grappling with how it should respond to rising inflation – until now looking upon it as a transitory phase following the coronavirus downturn and playing down the idea of pulling away support.

US stock markets joined the sell-off at Thursday’s open on Wall Street, with the S&P 500, tech-focused Nasdaq and Dow Jones Industrial Average all trading down by almost 1.5%.

On the other side of the Atlantic, adding to anxiety about the US were the results of the European Central Bank (ECB)’s review of its own monetary policy.

The ECB is tweaking the way it targets 2% inflation to try to show it is just as worried about price growth being too low as being too high.

Yet it stopped short of committing to an inflation overshoot – which would effectively mean keeping the stimulus taps on for longer – to make up for long periods of low inflation.

That seemed to prove a disappointment for investors who might otherwise have hoped for ultra-low interest rates and a vast bond purchase programme to continue long after the pandemic crisis has passed.

Adding to the depressed sentiment were signs of a growing crackdown on China’s tech sector as well as concern over the strength of the country’s economic recovery.

Combined with fears about a resurgence in coronavirus cases, it was enough to put a big dent in global investors’ appetite for risk.

Susannah Streeter, senior investment and markets analyst at Hargreaves Lansdown, said the most pressing issue hitting sentiment was inflation – particularly in the world’s largest economy.

“The combined chants of central banks that price rises wouldn’t be sustained over the longer term have hit a note of discord with Federal Reserve officials saying the recent inflation jump was higher than expected, and that the mass bond buying programme may need to be scaled back sooner rather than later,” she wrote.