‘Hubris, incompetence and greed’: Why Sam Bankman-Fried’s jail term is end of an era for crypto

Sam Bankman-Fried was breathlessly described as a wunderkind – a boy wonder transforming the world of finance.

Renowned for his messy hair and unkempt appearance, he graced the covers of Forbes and Fortune, who pondered whether he could become the next Warren Buffett.

The 32-year-old was the founder of FTX, which had quickly become the world’s second-largest cryptocurrency exchange – a place where investors could buy and sell digital assets like Bitcoin.

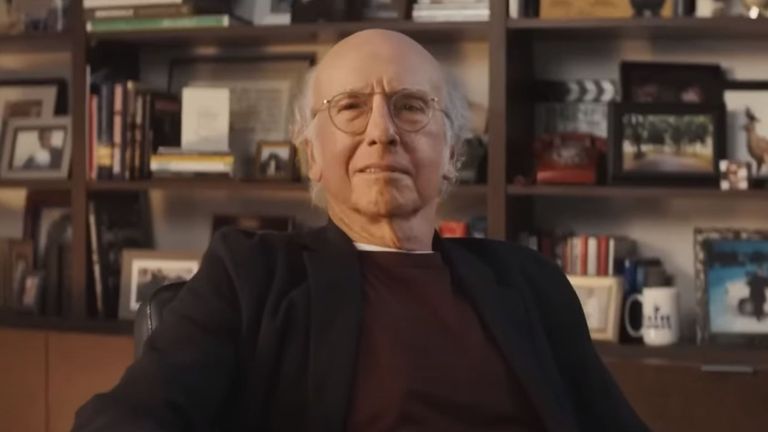

Star-studded adverts featuring the tennis player Naomi Osaka and the comedian Larry David added to its allure – with eye-watering sums spent on sponsorship deals.

But in November 2022, Bankman-Fried’s crypto empire came crashing down after it emerged that customer funds worth $10bn (£7.9bn) was missing.

A year later, a jury convicted the fallen entrepreneur of fraud and money laundering after just five hours of deliberations – based on evidence from close colleagues who had turned against him.

Now, “SBF” is beginning a lengthy prison sentence of 25 years for what prosecutors have described as “one of the biggest financial frauds in American history”.

His punishment may be little comfort to five million FTX customers who were suddenly locked out of their accounts as the company entered bankruptcy – and are yet to receive any compensation.

An estimated 80,000 of Bankman-Fried’s victims were based in the UK. Some of them had millions of pounds tied up in the company after entrusting him with their life savings.

While slick marketing campaigns had presented FTX as a safe way to invest in volatile cryptocurrencies, the reality behind the scenes couldn’t have been more different.

Secret back doors had been established that allowed SBF’s other company, Alameda Research, to access money belonging to FTX customers and make risky bets without their knowledge.

Meanwhile, executives were spending lavishly. Private jets ferried Amazon orders from Miami to the firm’s headquarters in the Bahamas, £12m was spent on luxury hotel stays in just nine months, and employees in the US were allowed to order £160 of food deliveries each a day.

The fallout from FTX’s demise also reaches as far as the White House. Bankman-Fried was one of the largest donors to Joe Biden’s campaign in 2020, with the president subsequently facing pressure to return millions of dollars.

Read more:

Who is Sam Bankman-Fried?

SBF ‘wanted to be US president’

A new chief executive has been tasked with untangling where all the money went. Soon after FTX went under, he said: “Never in my career have I seen such a complete failure of corporate controls.”

Unusually, and thankfully, FTX victims are expected to be compensated in full eventually – kind of.

The payouts they receive will be based on what cryptocurrencies were worth in November 2022. But Bitcoin was trading at £16,000 back then and is now worth £55,500.

Bizarre plans to bring FTX out of bankruptcy and reopen the exchange have also been abandoned.

Other entrepreneurs in this space – who had loyal, cult-like followings and huge profiles – are also facing jail time.

Changpeng Zhao, who ran the world’s biggest crypto exchange Binance, sensationally resigned last year after pleading guilty to money laundering violations in the US.

His company had allowed individuals in Syria, Iran and Russian-occupied parts of Ukraine to evade economic sanctions – and allegedly made it easy for terrorists and criminals to move money.

The billionaire faces jail time when he is sentenced next month.

Do Kwon created two cryptocurrencies that spectacularly collapsed in May 2022, with investors losing an estimated $40bn (£31.7bn) in a matter of days.

He later went on the run but was captured in Montenegro last year after attempting to fly to Dubai using a fake passport.

A civil fraud trial against Kwon and his company Terraform Labs began this week, with prosecutors warning: “Terra was a fraud, a house of cards, and when it collapsed, investors nearly lost everything.”

In a way, Bankman-Fried’s sentence marks the end of an era for crypto – when extravagant excesses and a lack of regulatory oversight were the norm.

Bitcoin’s recent gains have been driven by regulated products that allow investors to gain exposure to the cryptocurrency’s price without owning it directly.

And many of these products are offered by established, traditional finance firms like BlackRock, which is the world’s largest asset management company.

A damning report described the rise and fall of FTX as a tale of “hubris, incompetence and greed” – with Bankman-Fried and his inner circle showing little regard for the financial wellbeing of his customers.

Be the first to get Breaking News

Install the Sky News app for free

Millions of people had their fingers burned, and many will be put off from ever investing in cryptocurrencies again.

But while the industry has learned some lessons, the crypto market’s rapid surge in recent months mean there’s a real risk of another bubble forming – and new bad actors taking advantage of investors looking for a piece of the action.