Inflation hits new 30-year high as chancellor expected to ease cost of living crisis

The annual rate of inflation has hit 6.2%, adding pressure on the chancellor to help households with soaring living costs in his spring statement.

The consumer prices index (CPI) increased to a new 30-year high in February – up from 5.5% in January, according to the Office for National Statistics (ONS).

The figure was larger than expected by economists, who had predicted a rate of 5.9%.

Watch and follow the chancellor’s spring statement on Wednesday from 12.30pm on Sky News.

The largest contributors to growing inflation were increased energy bills and fuel prices, the ONS said.

Key factors in the change from January to February were soaring costs for “a variety of recreational and cultural goods and services (principally games, toys and hobbies), and clothing and footwear”, it added.

Food prices were said to be rising across the board, unlike in normal times when some prices typically go up and others drop.

What does the spring statement mean for you? Ask our specialists a question now

ONS chief economist Grant Fitzner said: “Inflation rose steeply in February as prices increased for a wide range of goods and services, for products as diverse as food to toys and games.

“Clothing and footwear saw a return to traditional February price rises after last year’s falls when many shops were closed.

“Furniture and flooring also contributed to the rise in inflation as prices started to recover following new year sales.

“The price of goods leaving UK factories has also been rising substantially and is now at its highest rate for 14 years.”

Read more: How much a 5p cut in fuel duty saves on filling your tank and what makes up the cost of petrol

Inflation expected to keep soaring

The ONS data did not fully reflect the impact of the war in Ukraine because the invasion began near the end of the month.

Inflation is set to continue climbing, with the Bank of England warning that it could reach 8% next month, driven by the 54% rise in the energy cap that is set to come into force on 1 April and will affect 22 million households.

The cap is set to soar by almost £700 on average in response to rising wholesale prices, which have since been pushed even higher due to the invasion and sanctions imposed on Russia in retaliation for its move.

It could mean energy bills going up by a further 35% when the cap is reset in October, according to the bank’s monetary policy committee, while spikes in other essential commodities, such as wheat and metals, will also add to the squeeze on household finances.

Chancellor under pressure

The chancellor’s spring statement, often described as a “mini budget”, will provide an opportunity for him to address the challenges facing families and businesses.

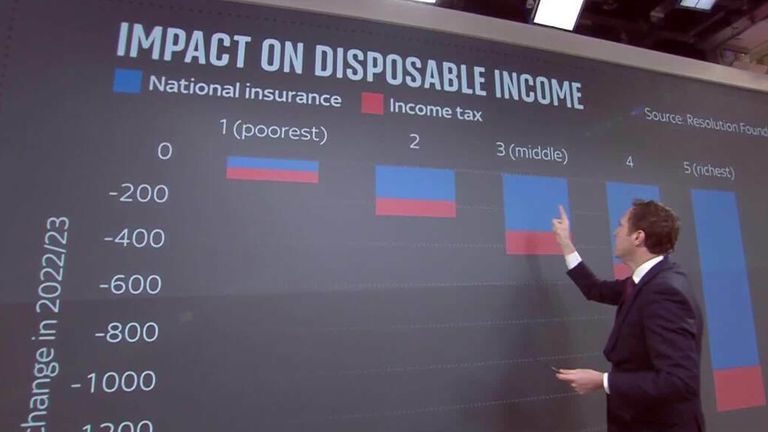

Reports suggest he could cut fuel duty by 5p per litre and raise the income level at which national insurance becomes due.

Mark Harper, Tory MP for the Forest of Dean, said he now faces a “very difficult and challenging backdrop”.

“The chancellor has got competing pressures today,” he told Sky News.

He said Mr Sunak “understands the situation facing consumers and businesses” but also needs to take into account growing interest on government debt due to inflation and “build in some resilience to deal with whatever the future may throw at us”.

Former shadow chancellor John McDonnell called on the government to protect those who will be hit hardest – people on pensions, benefits and low pay – and said rent freezes and transport fare controls should be imposed.

He told Sky News “green growth” measures to help people insulate their homes would also reduce their energy bills.