Markets react on second open after budget – as traders concerned over some announcements

The cost of government borrowing jumped on Friday morning, while UK stocks and the pound are up, as markets digest the news of billions in borrowing and tax rises announced in the budget.

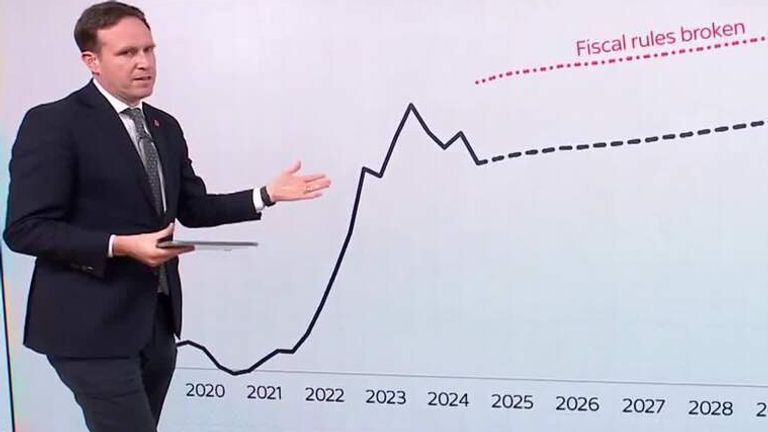

While there was no panic, there had been concern about the scale of borrowing and changes to Chancellor Rachel Reeves‘s self-imposed borrowing rules.

At the market open on Friday, a calming was visible. But the interest rate on government borrowing stood at 4.476% on its 10-year bonds – the benchmark for state borrowing costs.

It’s down from the high of yesterday afternoon – 4.525% – but a solid upward tick.

As the morning wore on that high came into view with the interest rate, known as the yield, creeping up to 4.492% before falling back to 4.438%.

Money blog: 101 areas where rent is now officially unaffordable mapped

The pound also rose to buy $1.29 or €1.1873 after yesterday experiencing the biggest two-day fall in trade-weighted sterling in 18 months. The values are also higher than for the vast majority of the last two years.

On the stock market front, the benchmark index, the Financial Times Stock Exchange (FTSE) 100 list of most valuable companies was up 0.36%.

The larger and more UK-focused FTSE 250 also went up by 0.1%.

While there was a definite reaction to the budget, uniquely impacting UK borrowing costs, the response is far smaller than after the UK mini-budget.

Other factors at play

Many forces are affecting markets, with the upcoming US election on a knife edge and interest rate decisions in both the UK and the US coming on Thursday.

For the past month, UK government debt costs rose in line with American borrowing costs. Traders had been pricing in a possible second Trump presidency and the impact his potentially inflation-rising policies could have.

But the interest rate, or yield, on UK and US 10-year government bonds, departed from each other on Wednesday afternoon after the budget.

At that point, the yield on UK 10-year bonds, known as gilts, began to rise and despite some falls has been on an upward trend.

Budget latest: Darren Jones says UK has ‘PTSD’ from Liz Truss

Also affected by the budget is the chance of an interest rate cut by the Bank of England. While the likelihood of a drop is still high at 83%, it’s down from a 94% chance yesterday on Wednesday morning.

A warmer reception

The concern among bond traders was not felt across the business world, as the chief executive of Barclays, CS Venkatakrishnan, told The Financial Times Ms Reeves had done an “admirable job”.

“I think they’ve done an admirable job of balancing spending, borrowing and taxation in order to drive the fundamental objective of growth,” he said.

Be the first to get Breaking News

Install the Sky News app for free

He is one of the CEO members of the government’s national task force.

Credit rating agency Moody’s, however, said borrowing plans announced in the budget were an “additional challenge”.

The new government has just committed itself to far higher lending – about £140bn more borrowing in the coming years, while tax-raising measures will bring in an extra £40bn a year.