Oil and gas costs ease and FTSE 100 recovers all Ukraine invasion losses

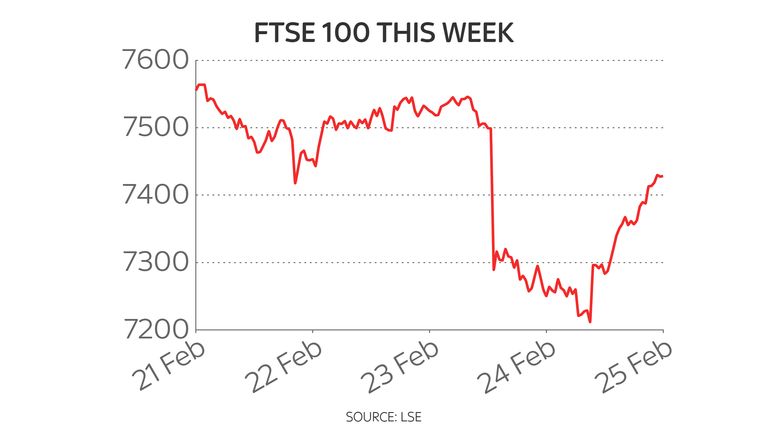

Oil and gas prices have fallen back while the FTSE 100 has recovered the value it lost during its worst day since June 2020, triggered by Russia’s invasion of Ukraine.

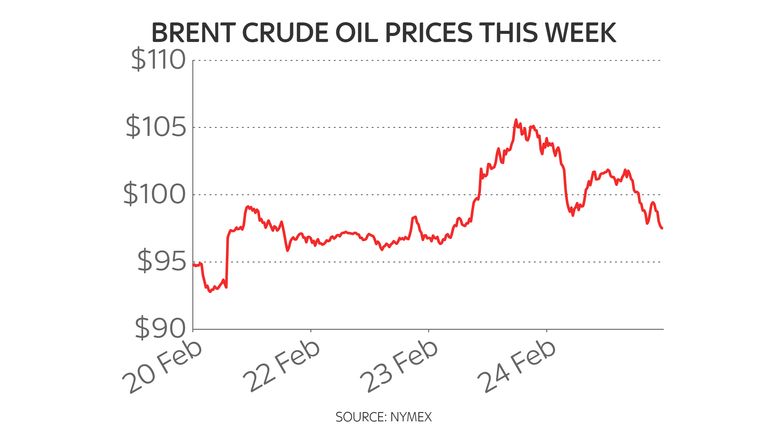

The cost of Brent crude returned to levels before the Kremlin attack at $97 a barrel – down from a widely-traded high of $105bn on Thursday which had fuelled fears of further petrol price hikes and a deterioration in the wider cost of living crisis.

The UK contract for March natural gas delivery was also down 29% on Friday at 228p, although still up from the 173p level seen earlier in the week, helping calm warnings about even larger hikes to bills ahead.

Troops enter Kyiv as residents told ‘make petrol bombs and neutralise the occupier’ – latest updates

Despite uncertainty about Ukraine and the worries over inflation, an overnight rebound on Wall Street appeared to pout momentum behind Asian and European shares during Friday’s trading.

Investors appeared relieved that sanctions against Russia were not as severe as they might have been and that conflict had not spread.

Vladimir Putin’s invasion of Ukraine sparked a barrage of fresh, targeted financial sanctions meant to isolate and punish Moscow.

But while the US, Europe and other countries ramped up efforts to curb the Kremlin’s ability to do business for the attack on Ukraine – freezing bank assets and cutting off state-owned enterprises – they stopped short of ditching Russia from the SWIFT international banking system or targeting its oil and gas exports, which some analysts said had helped markets to recover.

Market players may also be betting that the crisis could slow moves by central banks to slow inflation by raising interest rates and cutting other support for pandemic-hit economies.

In the UK, the top-flight FTSE closed the day 3.9% higher, recovering all of Thursday’s 3.9% slump that wiped £77bn off the collective value of its constituent companies.

Only two blue-chip stocks ended Friday in the red while those which suffered most during the widespread sell-off put back some value.

Banking shares were among the rally’s beneficiaries.

AJ Bell investment director Russ Mould said: “Despite war continuing to rage in Ukraine the FTSE 100 managed decent gains on Friday as investors make slightly queasy calculations about the extent to which the economic and market impact of Russia’s invasion will be contained.

“The index took its cue from a dramatic reversal in the US overnight.”

The second tier domestic-facing FTSE 250 was also up by almost 3% – as were the French CAC and DAX in Germany.

The worst one day selling to hit Moscow’s main indexes was followed by a rally too, with the MOEX rising almost 20% and the RTS index rising by 27%.

Jeffrey Halley, senior market analyst at OANDA, said in a note: “The limits to the economic pain that the ‘West’ was prepared to tolerate to support Ukraine and punish Russia have been revealed within 24 hours of Russia’s offensive beginning.

“The Russian offensive has occurred in a time of already high inflation and commodity shortages globally, and the West has blinked immediately. The process of throwing Ukraine under the geopolitical bus has begun.

“Markets clearly felt the same way, that this is the worst it can get.”

But some analysts worry any rallies might be fleeting.

Subscribe to the Daily podcast on Apple Podcasts, Google Podcasts, Spotify and Spreaker

Kyle Rodda, analyst at IG Markets in Melbourne, said: “Biden’s sanctions and reluctance to pour troops in is providing some relief.

“But this conflict is going to be a protracted issue and add to global inflationary pressures that will keep central banks on track for tightening.

“It’s okay for now, but in the long-term the market will be tracking to the downside.”

Meanwhile, UK flights to and over Russia have been banned by the country’s civil aviation authority in retaliation for a British ban on Aeroflot in UK airports and airspace.

In other developments, Formula One has cancelled the 2022 Russian Grand Prix and UEFA has moved the Champions League final to Paris following the invasion of Ukraine, a statement has confirmed.

The final was set to be played at the Gazprom Arena in the Russian city of St Petersburg on 28 May, but this has been changed to the Stade de France in Paris instead.