Oil price tops $80 and gas costs soar further as consumers face bill heat ahead of winter

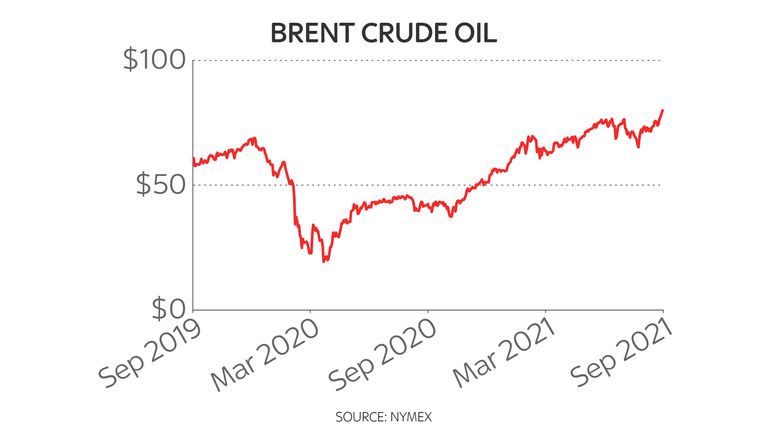

Oil prices have topped $80 a barrel for the first time in three years while wholesale gas costs have surged dramatically – likely adding to pressure on drivers and household energy bills in the months ahead.

Brent crude rose for a sixth day in a row as concerns over global supply coincide with more countries, such as Japan, easing COVID-19 restrictions, which is likely to boost demand.

UK wholesale gas costs for winter delivery were up 20% on Tuesday above 218p-per-therm – building on a price swell of almost 500% over the past 12 months.

However, there was some rare cheer for the energy market as it emerged that the owner of the Stanlow oil refinery, that supplies about one-sixth of Britain’s road transport fuels, had struck a deal with HM Revenue & Customs on a deferred tax bill to remove immediate questions about its future and ability to handle supplies.

Oil prices are rebounding after Brent crude dipped below $20 a barrel last year in the early days of the pandemic – and a separate US benchmark, WTI, even briefly turned negative.

It could add to accelerating price rises for UK consumers, at a time when inflation is at a nine-year high and the Bank of England expects it to top 4% by the end of the year.

Motorists are already facing a headache as panic-buying sparked off by worries about a shortage of fuel tanker drivers creates long queues at forecourts – and with petrol prices at an eight-year high.

Follow the Daily podcast on Apple Podcasts, Google Podcasts or Spotify.

The RAC, the motoring organisation, has accused “a small number of retailers” taking advantage of the situation by hiking prices.

The government has said the army is on standby with soldiers at “increased preparedness” to help deliver fuel if necessary.

But ministers and petrol retailers are hoping that after motorists drained pumps in recent days there will be a return to calm.

The panic-buying has led to industries from taxi drivers to the meat processing sector – and even non-league football – facing difficulties and prompted calls for health workers to get priority.

It adds to a cocktail of supply chain problems already created by the HGV driver shortage as well as a gas price spike across Europe that has led to the collapse of a series of smaller energy companies.

Among the pressures on energy supply has been a lack of wind to generate renewable power.

It came as Bank of England governor Andrew Bailey said the UK economy was entering “hard yards” as inflation pressures grow and the recovery weakens.

Mr Bailey joked that when notified of this latest setback on fuel he was tempted to ask “and when are the locusts due to arrive?”.

The Bank governor acknowledged that recent evidence had strengthened the case for a “modest tightening of policy” – that is, raising interest rates or scaling back the Bank’s £895bn bond purchasing programme to try to rein in inflation.