Primark plots price hikes as sales rise 59% in first half of financial year

Primark has warned it will raise prices on selected lines later this year as it battles to maintain margins in the face of rising costs.

The budget fashion chain’s parent firm Associated British Foods (ABF) used the publication of its half-year results to say that it was facing intense inflationary pressures across its businesses.

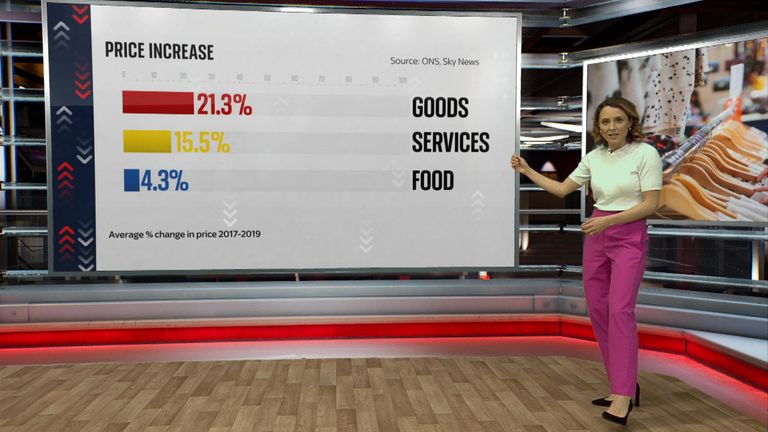

The warning is in line with firms across the world that are juggling higher costs for things like energy and raw materials amid COVID supply chain disruption and latterly Russia’s war in Ukraine.

Primark, it said, had not been able to offset rising bills through cost-cutting alone.

Some autumn/winter stock would be adjusted upwards from August, ABF said, and it declined to divulge figures but added that it was now forecasting a full-year operating margin of 10%.

That was down from the 11.7% projected for the first half of its financial year to 5 March, suggesting that the price rises would not fully compensate for the tide of costs.

Primark’s sales rose by 59% in that period, compared to the same six months last year, to £3.54bn.

ABF said it reflected the easing of COVID restrictions that have hammered the business.

Primark’s refusal to sell goods online savaged sales when lockdowns forced its store estate to close for periods in both 2020 and 2021.

Nevertheless, experience since the financial crisis shows that retailers with a budget focus tend to do better than most at a time when household budgets are also under severe strain from surging bills.

The inflationary picture is only predicted to get worse as everyday items – such as food and energy – become more expensive across the economy.

ABF said Primark sales had recovered well in the UK, but business had been slower to get back up to speed on the continent.

Commenting on the move to raise selected prices, chief financial officer John Bason told the Reuters news agency that Primark was keeping its pledge not to raise prices for current spring/summer stock.

“We will absolutely ensure that we are the best value around, that’s not going to change,” he said.

Rival Next said last month that its prices would rise by up to 8% this year.

Shares in ABF were down around 5% in the wake of its results.

Analysts placed much of the blame on a further forecast margin reduction for the group’s food businesses, including grocery brands Twinings tea, Jordans cereals, Kingsmill bread and Ovaltine.

Sales rose 6% to £4.4bn over the six months but ABF said Russia’s invasion of Ukraine had placed more pressure on costs than it had expected.

The company, which also owns major sugar, ingredients and agricultural businesses, reported first-half adjusted operating profit of £706m – nearly double the same period last year.

Chief executive George Weston told investors: “This half year sales and operating profit for the group returned to pre-COVID levels.”

But he added: “Measures to mitigate higher costs in all our businesses have been taken and more are planned.

“Looking further ahead, inflationary pressures are such that we are unable to offset them all with cost savings, and so Primark will implement selective price increases across some of the autumn/winter stock.

“However, we are committed to ensuring our price leadership and everyday affordability, especially in this environment of greater economic uncertainty.

“Notwithstanding the inflationary pressures we are experiencing, our outlook for the year is for significant progress in adjusted operating profit and adjusted earnings per share for the group.”