Rishi Sunak says financial services deal with EU ‘has not happened’

Britain’s attempt to reach a post-Brexit financial services deal with the EU “has not happened”, Rishi Sunak has told the City.

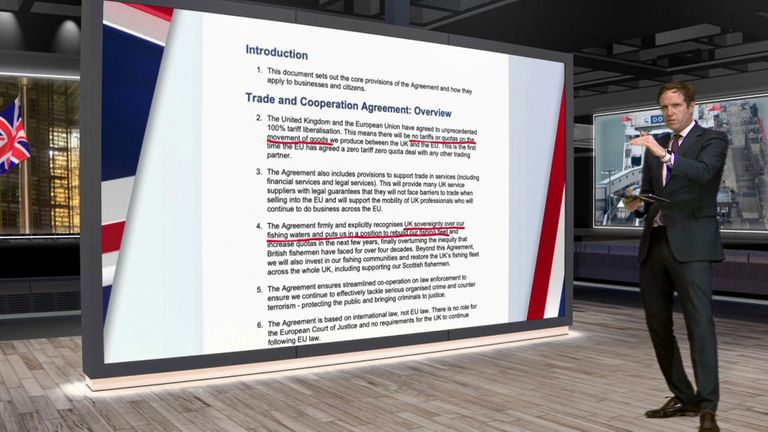

The sector was not covered in the UK’s last-minute free trade agreement when the Brexit transition period ended in December and the government has since been seeking an “equivalence” arrangement with the bloc.

But in the chancellor’s traditional Mansion House speech to the City, Mr Sunak said: “That has not happened.

“Now, we are moving forward, continuing to cooperate on questions of global finance, but each as a sovereign jurisdiction with our own priorities.

“We now have the freedom to do things differently and better, and we intend to use it fully.”

The chancellor said Britain needed a plan for the industry “which sharpens our competitive advantage while acting in the interests of our citizens and communities”.

Part of that will include reforms aimed at encouraging more firms to list on London’s stock market and the abolition of some regulatory requirements for trading inherited from the EU.

In his speech, Mr Sunak acknowledged the role of the financial services sector, contributing £76bn in taxes annually and employing 2.3 million people.

An estimated 7,500 financial jobs have shifted to EU hubs as a result of Brexit, which saw UK firms lose so-called “passporting” rights that had enabled them to trade more freely with European countries.

Since then, efforts – now apparently abandoned – have focused on securing “equivalence” status, where Brussels and Whitehall would each recognise that the other holds to similar standards.

But there has been frustration on the UK side at Europe’s apparent intransigence in granting access to the bloc in a way that has already been granted to Canada, the US, Australia, Hong Kong and Brazil.

In his speech on Thursday, Mr Sunak insisted: “The EU will never have cause to deny the UK access because of poor regulatory standards.”

The chancellor also addressed London’s dominant role in clearing – a business sometimes described as the plumbing of the financial market which deals with tens of trillions euros worth of transactions every year and which has also been the subject of a tussle with Brussels in recent months.

Follow the Daily podcast on Apple Podcasts, Google Podcasts, Spotify, Spreaker

Mr Sunak insisted that he saw no reason why the UK “should not continue to provide clearing services for countries in the EU and around the world”.

Other topics laid out in his Mansion House speech included safeguards for access to cash – a topic that has risen up the agenda as free-to-use ATMs and bank branches close – and requirements for companies to disclose the impacts they have on the environment.

The chancellor also set out hopes for a “ground-breaking” system of cross-border access for financial services with Switzerland.

Meanwhile, a few more details about plans by the Treasury to issue £15bn worth of green bonds have been revealed.

The three-year bonds will offer savers the chance to support green projects by investing between £100 and £100,000 over a three-year term at a fixed rate – which will be announced later this year.