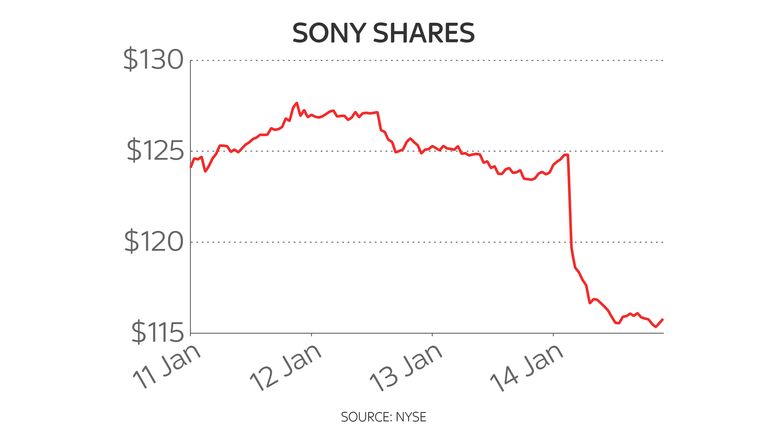

Sony in shares slump after Microsoft’s Activision Blizzard swoop

Shares in PlayStation maker Sony have plunged after rival Microsoft, the company behind rival games console Xbox, agreed to buy games developer Activision Blizzard for $68.7bn (£50.5bn).

The Japanese technology giant slumped by nearly 13% in Tokyo hours after the US firm said it would buy the business whose titles include Call of Duty and Candy Crush.

It represents a new challenge in the console battle in which the PlayStation is currently widely seen as having the upper hand.

The concern for Sony could be that Activision games might be pulled from the PlayStation’s systems – though that would mean sacrificing the major source of revenue that PlayStation currently provides the developer.

It could also put pressure on the Japanese conglomerate to respond by pursuing big acquisitions of its own.

Sony has been strengthening its network of in-house games studios in recent years and has delivered a string of hits including in its Spiderman franchise.

It also has titles such as Gran Turismo 7 and Horizon Forbidden West in the pipeline.

Microsoft has leaned heavily on its Halo series, whose latest instalment was delayed before its release in December.

Meanwhile, it has been aggressively expanding its Game Pass subscription service.

Announcing the Activision takeover on Tuesday, Microsoft’s boss Satya Nadella said it would give the Xbox firm a leap into the mobile gaming sphere and position it for a key role in the “metaverse”, a proposed immersive experience where people shop, game and socialise online.

Sony is a global conglomerate behind products such as TVs and smartphones as well as owning film and music making businesses.

But Microsoft, which makes software and provides cloud services, has a market capitalisation that is more than 14 times bigger.

David Gibson, an analyst at MST Financial, told the Financial Times: “The market is guessing what might happen to Call of Duty.

“It looks like economic suicide if Microsoft makes the franchise exclusive to its own platform, but they may not care if it makes their platform stronger.”