State-backed loans being considered for energy firms that take customers from companies that go bust

Some of the UK’s biggest energy companies could be offered state-backed loans in return for taking on customers from smaller suppliers if they go under, as soaring global gas prices throw the industry into crisis, the business secretary has told Sky News.

Speaking to Kay Burley, Kwasi Kwarteng also said that the carbon dioxide shortage that has affected some food and drink production could be solved by the end of the week.

Asked about the energy crisis, Mr Kwarteng said there are “lots of options” at the disposal of ministers.

“It costs a company to absorb up to hundreds of thousands of customers from another company that’s failed, that costs money, and there may well be a provision for some sort of loan and that’s been discussed,” he said.

But the business secretary stressed he did not want to be “throwing taxpayers’ money” at companies which have been “badly run”.

“Every year between five and eight companies exit the market and I don’t want to prop up failing companies, I don’t want there to be a reward for failure,” he added.

Mr Kwarteng insisted it was a “myth” that the UK supply of gas could run out and stressed “security of supply is not an issue”.

He acknowledged some people may already struggle to heat their homes because of the cost of their energy bills, but said it would not be down to a lack of supply.

Speaking in the Commons on Monday, Mr Kwarteng said there is “absolutely no question of the lights going out this winter”.

He also told MPs that the energy price cap will remain in place.

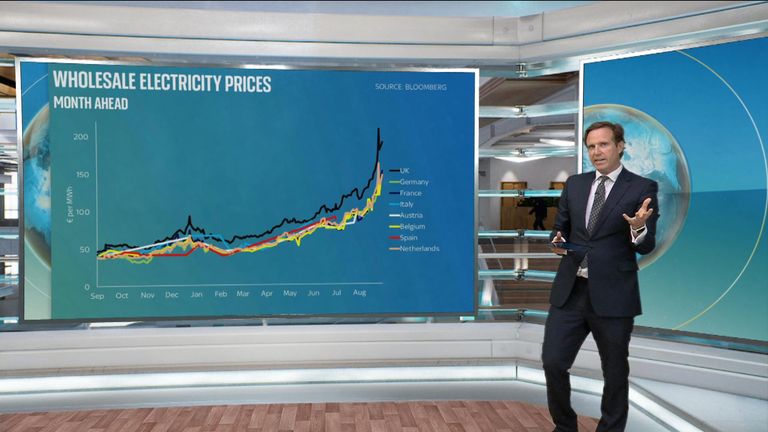

Wholesale prices for gas have increased 250% since the start of the year, and there has been a 70% rise since August.

Consumers are protected from sudden price hikes by the energy price cap, but this puts pressure on suppliers as they cannot pass on the increase in wholesale gas prices to customers.

The rise has been put down to a number of factors, including a cold winter leaving stocks depleted, high demand for liquefied natural gas from Asia and a drop in supplies from Russia.

Four small UK firms have already gone bust and there are fears that others could follow suit, with energy company Bulb, which has 1.7 million customers, confirming it is seeking a bailout to stay afloat.

The price cap is reviewed by Ofgem, the sector’s regulator, every six months.

Analysts have said that around 15 million households will be hit by an annual increase of £178 in their energy bills when the next one is carried out in April.

This would represent a 14% increase on the £1,277 price cap that is due to come into effect from next Friday.

Turning to the issues with CO2 production, the business secretary sounded a confident note.

He said a resolution to the issues experienced was “pretty imminent” and added: “I’m very confident and hopeful that we can sort it out by the end of the week.”

“I think we have to have a diversity of sources of carbon dioxide there,” Mr Kwarteng continued.

“CF [a US company that provides 60% of Britain’s carbon dioxide and has stopped operations at two plants] isn’t the only company that manufactures carbon dioxide.

“They have a big share of the market, I said they weren’t the only one. But they are… a big part of the carbon dioxide market.”

Food producer Bernard Matthews warned Christmas dinner could be “cancelled” as a result of the stoppages at the two plants.

Carbon dioxide is crucial to the food processing industry in packaging meat products and culling animals.

Meanwhile, the chief executive of the British Meat Processors Association has warned the country could be two weeks away from seeing meat disappearing from supermarket shelves.