Ted Baker up for sale as bid interest in fashion chain intensifies

Fashion retailer Ted Baker has launched a formal sale process after receiving an improved takeover proposal and new bid interest.

The company revealed to the City on Monday morning that private equity firm Sycamore – whose bid interest was first revealed by Sky News – had raised its unsolicited proposal for a third time, but did not reveal by how much.

Just a week earlier, Ted Baker had rejected a second offer by the New York-based firm, which valued the retailer at £253.8m, on the grounds it significantly undervalued the company.

Shares jumped by more than 12% when news of the third proposal was revealed, though Ted Baker did not identify the other party said to have shown interest in a takeover.

The sale process allows talks with interested bidders to take place on a confidential basis.

Its statement said: “The board has decided to conduct an orderly process to establish whether there is a bidder prepared to offer a value that the board considers attractive relative to the standalone prospects of Ted Baker as a listed company.”

The company said it did not know if Sycamore wished to participate in the process.

Profit warnings and accounting mishaps

Ted Baker trades from hundreds of standalone shops and concessions globally, and employs thousands of people, but it has struggled since the 2019 departure of founder Ray Kelvin amid claims of inappropriate behaviour towards female colleagues. He has consistently denied those allegations.

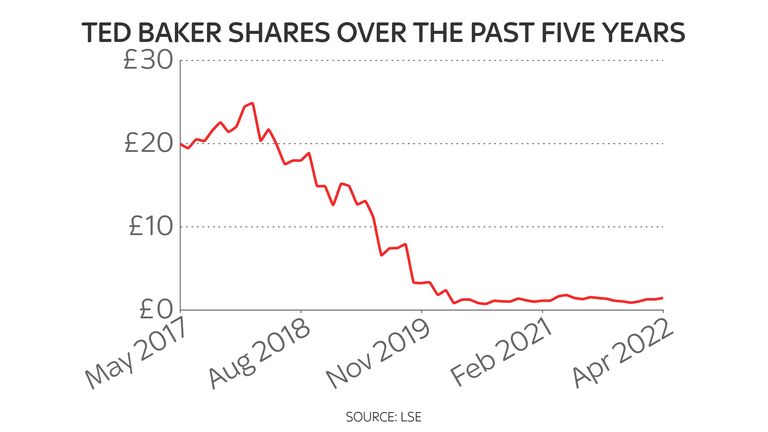

Any sale of the business would unlock a windfall for Mr Kelvin, who retains an 11.48% stake, though shares are currently trading at a fraction of their former glory.

Since 2019 Ted Baker has been hit by profit warnings, accounting mishaps and was forced to address the COVID-19 pandemic from a position of relative financial weakness.

In 2020, it axed hundreds of jobs and raised £100m to shore up its balance sheet.

Commenting on the bid interest Sophie Lund-Yates, equity analyst at Hargreaves Lansdown, said: “The structural decline in retail, coupled with Ted’s exposure to occasionwear, which was one of the worst hit areas during lockdowns, have made for very challenging conditions.

“The price that Ted Baker will accept from a buyer is clearly more ambitious than what the existing bids offer.

“Ted is keen to point out the potential growth for the brand, including around the benefits of a new leaner, more digital operation.

“There may well be a disconnect between Ted Baker’s valuation of itself and the amount a third party is willing to spend on a much improved, but nevertheless struggling, bricks and mortar retailer.”