THG suffers fresh blow as largest institutional investor cuts stake by half

Troubled online retailer and logistics specialist THG, formerly known at The Hut Group, has suffered a fresh blow after its biggest institutional investor revealed it was selling almost half its stake – and at a discount.

US asset manager BlackRock had a 10.13% stake of nearly 124 million shares as of mid-October but said on Tuesday that it would offload 58 million at a price of 195p each – a 10% reduction to Monday’s closing price.

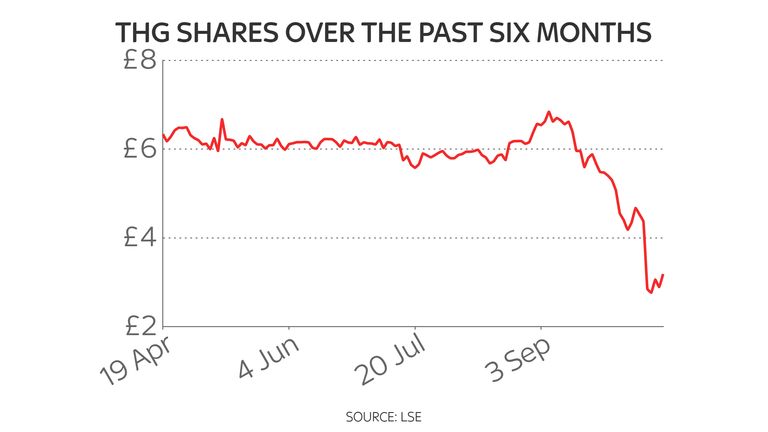

The sale follows a rocky month for THG in which its share price sank some 57% as investors were left underwhelmed by a company presentation focusing on its e-commerce technology platform Ingenuity.

The company’s efforts to restore confidence have had little impact to date.

THG confirmed a fortnight ago that it was examining a shake-up of its corporate governance amid criticism around its founder, chief executive and executive chairman Matthew Moulding’s dual role – which is rare for a UK-listed firm.

THG said he was also giving up his “golden share” rights and the company would seek a premium listing.

Shares were trading almost 6% down on Tuesday – leaving them 74% lower in the year to date.

It marks a significant comedown for a company that launched the biggest stock market flotation seen in London last year.

Russ Mould, investment director at AJ Bell, said: “The backlash against THG seems to centre on the fact that people bought into the hype without paying attention to valuation.

“Now that difficult questions are being asked about costs and more, particularly if the business is broken up into three as per the suggestion from THG, investors aren’t getting the answers they want – or they are not liking what they see.”