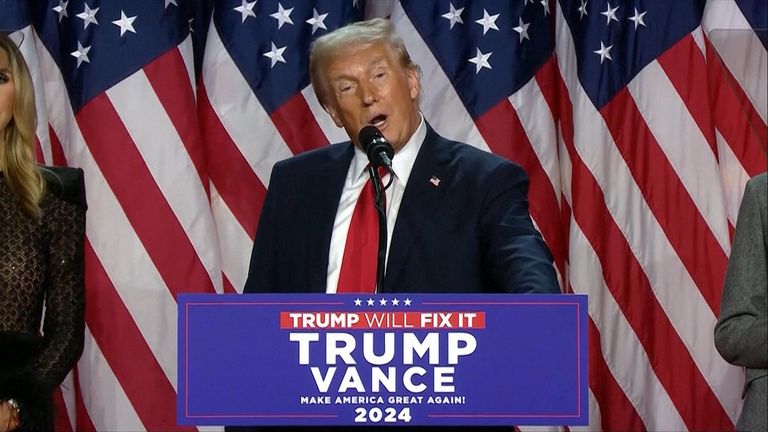

Trump tariffs to have ‘insignificant effect’ on UK economy

Plans by Donald Trump to impose blanket tariffs on all imports to the US will have an “insignificant effect” on the UK economy, according to a poll of international economists.

While policymakers at the Bank of England fret over the impact of threatened tariffs of up to 10% on UK goods and the prospects for a global spat, the study by Reuters suggested the UK could even be spared the charges altogether.

Their reasoning, the news agency found, was explained by the fact that the incoming US president was focused on correcting US trade deficits with other countries and trading blocs.

Money latest: You are (probably) overqualified for your job

The UK, now out of the European Union, and the US both report goods trade surpluses with the other.

The other major reason why the UK economy should get off lightly, they said, was down to the fact that the majority of UK trade with the US was in services rather than goods.

The same cannot be said for the eurozone nations.

A similar poll last month found that the bloc would be collectively harder hit due to a goods-led trading relationship with the US, with the fallout hurting growth for up to three years.

Even before Mr Trump takes office, the European Central Bank is widely expected to act against an economic slowdown by cutting interest rates for the third consecutive time later on Thursday.

That slowdown is being led by the euro area’s manufacturing powerhouse of Germany which is facing snap elections amid a slump in demand for many key goods, including cars.

The president of the country’s central bank has warned that its economy could “slip into negative territory” if Trump tariffs are imposed on top.

France is gripped by political deadlock that has fuelled worries over its public finances.

Mr Trump has threatened to impose the blanket tariffs from his first day in office next month, arguing they will protect American jobs.

How US trading partners respond will be key and it will leave Prime Minister Sir Keir Starmer facing a tricky balancing act.

A fifth of all UK trade is with the United States.

But the UK’s biggest trading partner remains the European Union, despite Brexit.

The government has begun efforts to patch up relations, including relaxing trade restrictions with the bloc, but could be forced to take sides in any looming trade squabble.

Four of the economists questioned by Reuters believed the UK would be fully spared the 10-20% US import charges.

China, Canada and Mexico are facing even higher tariffs.

Stefan Koopman at Rabobank said of the situation: “The UK is relatively well positioned to withstand the repercussions of President-elect Donald Trump’s proposed trade tariffs.

“Surely, as an open economy, the UK will inevitably feel the impact of a trade war, but likely to a lesser extent than countries that are heavily dependent on manufacturing and goods exports, such as Germany.”

Economists have widely warned that Mr Trump risks stoking US inflation by raising tariffs, with the additional cost of foreign-made goods ultimately being passed on to consumers.

While inflationary pressures in the US are already on tenterhooks, the UK is in a similar position.

Read more from Sky News:

British firms stop shipments to Northern Ireland due to EU rules

Government demands council plans for 1.5m new homes

Be the first to get Breaking News

Install the Sky News app for free

The Bank of England is widely expected to leave the Bank rate on hold at 4.75% next week following two reductions to borrowing costs this year.

It remains worried about the impact of raised trade tariffs on UK inflation, which is tipped to hit 2.6% next week from a current annual rate of 2.3%.

Nevertheless, economists and financial markets expect the Bank to make four interest rate cuts next year as it stands, unless there are further economic shocks.