Why the Bank of England is so optimistic on COVID recovery

Andrew Bailey is about to go on holiday.

But as the Bank of England governor’s mind turns to writing postcards, he knows he will soon be sending a more austere note to Rishi Sunak.

If inflation exceeds the Bank’s target rate of 2% by more than one percentage point in either direction, the governor is required to explain why in a letter to the chancellor.

The communication is a formality and a condition of the Bank’s independence in setting interest rates, but according to the Monetary Policy Committee (MPC) Mr Bailey chairs, it’s a certainty he’ll be putting pen to paper when he returns from his break.

The MPC now forecasts that inflation will touch 4% by the end of this year, double the target and a dramatic increase in its last prediction in May of a peak of around 3%.

A prediction of inflation running at double the target (in June it was 2.5%) would usually ring alarm bells in government and households across the country at the prospect of interest rates rising.

But the message from Mr Bailey and his colleagues is ‘don’t panic’.

They remain convinced that higher inflation is a blip in the post-COVID recovery and, while interest rates will need to increase from their historic low of 0.1% they will do so gradually, to 0.2% by the third quarter of next year and 0.4% a year later under the forecast horizon.

The factors driving inflation are well established. The pandemic disrupted global supply chains and there are still supply bottlenecks. The semiconductors from which microchips in cars, consumer electronics and much else are made, remain scarce.

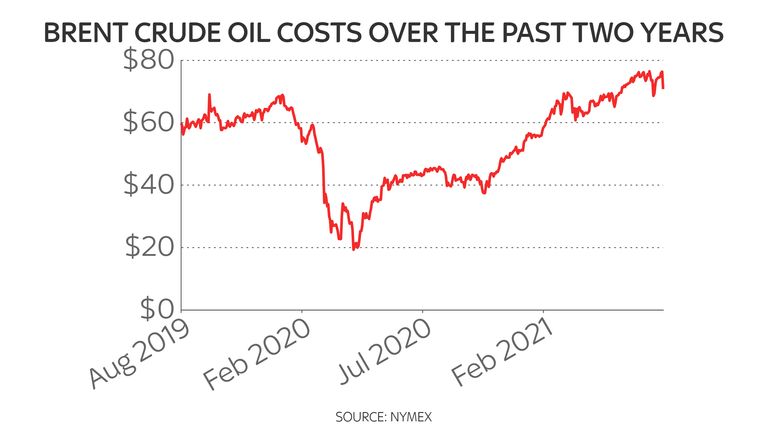

Fuel costs have also risen, albeit from record lows at the peak of last year’s lockdowns. Add a labour shortage, and pent-up demand, particularly for goods, and you have the conditions for rising prices.

Mr Bailey is confident it will pass, but insists he and his colleagues are not complacent.

“These are things we fully expect to be temporary, the world will come back to normal,” he told Sky News.

“But there are things that we are watching very carefully, because I want to emphasise that we don’t take this lightly by any means.”

The chief threat to this optimistic forecast, he says, is a continuation of the labour shortages that have affected industries from HGVs to hospitality.

Again, the MPC is confident vacancies will be filled and it paints a positive picture for employment.

Despite there being more than one million people still on furlough, it predicts unemployment has already peaked at 4.8%, and even when the scheme ends at the end of next month, people will be absorbed into the jobs market with no further increase.

Mr Bailey says even he is mildly surprised.

“I think the piece that has come out I think much better than we might have expected is unemployment.

“I remember back this time last year when we were forecasting seven, eight percent unemployment in this country. That would have been a very different story, had it come to pass,” he said.

For all the guarded optimism that the worst of the pandemic is over, these forecasts are underpinned by continued uncertainty over the course of the pandemic and the cost of controlling it.

By way of example, in the third quarter of this year GDP is expected to grow by 0.3%, lower than the 0.4% anticipated in May, a consequence the governor says of the continued spread of the Delta variant and the “pingdemic” of forced self-isolation that has hampered businesses reopening.

“Talking about the ‘ping’ issue, I think you have to look somewhat underneath that and say, of course, we’ve had the Delta variant, we have had the return of COVID, but now its economic effects have been far less than we were going through this time last year.”